Fatty infiltration of the liver is known to cause varying degrees of liver dysfunction. How do you prevent or reverse it? What about fatty infiltration in other organs?

One place to start would be to consider the possible role of fructose. Some people on a Paleo diet exclude it, but many (most?) don't.

Fructose is converted to fructose-1-phosphate in the liver, a process which can deplete the phosphate stores that normally would be used to create ATP, which is the body's primary source of metabolic energy. A lack of ATP triggers the degradation of adenine, which produces uric acid, which can lead to gout -- which is associated with metabolic syndrome. The fructose metabolites are then moved into fat storage, by increasing triglyceride levels in the blood. Fructose also increases insulin resistance.

http://www.ncbi.nlm.nih.gov/pubmed/16234313?dopt=AbstractPlus

As a result of the process above, fructose can then lead to fatty liver:

http://www.ncbi.nlm.nih.gov/pubmed/19403641

[[MORE]]Consuming PUFAs and alcohol can also contribute to liver injury and inflammation:

http://high-fat-nutrition.blogspot.com/2009/12/cirrhosis-and-fructose.html

I should mention that there's a difference between eating low-carb and being in ketosis. When you're in ketosis, the body is burning fat as a primary fuel, rather than glucose. Triglycerides are fats, and if you don't burn them up, they tend to accumulate. Triglyceride levels can go from being high to normal within 72 hours of going into ketosis.

Based on the research I've done, it is perfectly safe to be in ketosis for a few months at a time, and probably even longer. However, alternating out once in a while is prudent -- an expert I know advocates going out of ketosis twice a week or so, or maybe one week a month. In my case, making the transition isn't particularly easy, so I do it less often (out 1 month of every 6 feels like it would be about right, although it's more easily said than done).

A few interesting tidbits about ketosis: the brain's adaptation to ketones starts on about day 3, but isn't complete for about 2 weeks; I tend to feel a bit fuzzy during that adjustment period. After 2 weeks, though, the brain can derive 25% of its energy from ketones. The heart ejection fraction can increase by 30% within a few hours after an injection of ketones (helps with CHD). If you force cells to burn glucose, they turn cancerous relatively quickly; if you force them to use the same fuel they used in the fetal state (ketones), the cells tend to undifferentiate (stop being cancerous). Alkaline cancers, in particular, live on glucose; getting your blood glucose level down from 110 to 80 makes a huge difference in the cancer's ability to grow.

Leptin resistance can also be a factor in the body's use and accumulation of fat. Mold toxins can cause adverse effects on the leptin system, as well as aggravating insulin resistance. There's a book called "Mold Warriors" that talks about this (redirects to Amazon):

http://tinyurl.com/43bus2p

This may include various forms of subclinical intestinal yeast overgrowth (meaning it can be a problem with no obvious symptoms). Everyone has yeast in their gut and on their skin; it's a question of species and quantity, as well as the competitive balance with normal gut bacteria. Some fungal species, such as Candida rugosa, are resistant to certain antifungals, so just because you've been through a round of treatment doesn't mean the problem has gone away. Sometimes, treatment just changes the balance around, and can even make you worse (always a good idea to supplement probiotics when taking antifungal meds).

In addition, prostaglandin E2 (PGE2) can inhibit lipolysis (breaking down fats). You may be able to check yourself to see if your PGE2 levels are a factor. A niacin flush can significantly lower your PGE2 level (as well as histamine). One way to do the test is to start by dissolving a 24 hr dose of regular niacin (not niacinamide or no-flush niacin) in 8 oz of water. Then, take a sip and wait about 30 to 40 minutes for a flush. Then take a larger sip, wait, flush and repeat. You may need to repeat again for a few days, with steadily increasing doses per day. When you're done, the flushing should stop or nearly stop. After that, if PGE2 is a problem, you should be symptom-free for many hours. In general, the larger the flush, the higher your PGE2 levels.

Some people also have mitochondrial deficiencies. I have recently come to suspect that "subclinical" mitochondrial disease is much more widespread than is commonly accepted (particularly in brain-related illnesses, including schizophrenia, autism spectrum disorders and possibly epilepsy). This can also contribute to difficulties in effectively burning fat for fuel; you can run into a bottleneck of sorts. Experimenting with mitochondrial nutrients while in ketosis might help to both identify and treat some of those issues -- for example, carnitine, medium chain triglycerides, NADH, Lipoic Acid, B1, B2, B3 (NADH precursor) as niacin vs. niacinamide, B5, CoQ10 (std vs. ubiquinone) and N-Acetyl-Cysteine. You can assess yourself to see if they're helping by looking at your cognitive function (memory or something similar), strength, stamina, and/or body temperature.

12 Know More

Thursday, 6 October 2011

Monday, 26 September 2011

Elizabeth Warren's pitch for class warfare

I saw an interesting video recently (h/t jerrypournelle.com), with a short pitch by Elizabeth Warren in support of class warfare and the overall Left / Progressive agenda:

http://www.youtube.com/watch?v=htX2usfqMEs

First, here are her words:

Now let's take a closer look at what she said.

[[MORE]]

I paid for those roads as much as you did; probably more, since my income is above average, and roads benefit others much more than me.

I paid to educate people, too. I paid property taxes (the source of educational funding in California) for 30+ years, and never sent my kids to public school. I am also not the only person to benefit from the education of others.

More fundamentally, though, so what if others paid for my employee's education? If someone's parents paid for their child's education rather than taxes, should an employer be expected to pay the parents back? When I hire someone, I am paying them in accordance with their skills, knowledge and abilities. It's a mutually beneficial arrangement: employees get an income, and I get the benefit of their efforts; the more educated they are, the more they earn (to a point). Win-win.

BTW, the quality of US public education generally sucks. In many cases, I would often prefer to hire people who haven't been damaged by it.

Those police and fire forces are using facilities and equipment that people like me designed and built for them -- structures, vehicles, computers, communications, etc, etc.

And again, I paid for those services as much as anyone else. And again, I'm also not the only one to benefit from them.

Police and fire services don't really keep me safe anyway; safety is much more a function of morality. Installing a new police force in Somalia wouldn't change anything.

OK, now we're getting to the meat of it.

First, there is no social contract. That's simply an invention the Left uses to try to impose guilt or duty on us. A contract requires conscious and voluntary agreement between parties, and it presupposes the ability to reason, discuss and even disagree, so it's not something you can be born into. I certainly never agreed to anything like what Warren implies. What if I had been born in the Soviet Union or Nazi Germany? By Warren's logic, I would be required to live by those "social contracts" as well. No thanks.

My individual rights are not negotiable. No one, including government, has the right to take from me because of some perceived need -- or for any other reason. My life belongs to me.

Finally, perhaps the most important point: when I create a business, I am adding value to the world. I am employing people and producing a product or service that others value more than the money they give me in exchange. How about some thanks, some appreciation for that? No, the Left don't want to thank me, they want to destroy me; they want to steal my earnings while trying to portray me as evil. Why am I evil? Because I am successful, because I am good.

http://www.youtube.com/watch?v=htX2usfqMEs

First, here are her words:

You built a factory out there? Good for you. But I want to be clear: you moved your goods to market on the roads the rest of us paid for; you hired workers the rest of us paid to educate; you were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn’t have to worry that marauding bands would come and seize everything at your factory, and hire someone to protect against this, because of the work the rest of us did.

Now look, you built a factory and it turned into something terrific, or a great idea? God bless. Keep a big hunk of it. But part of the underlying social contract is you take a hunk of that and pay forward for the next kid who comes along.

Now let's take a closer look at what she said.

[[MORE]]

You built a factory out there? Good for you. But I want to be clear: you moved your goods to market on the roads the rest of us paid for

I paid for those roads as much as you did; probably more, since my income is above average, and roads benefit others much more than me.

you hired workers the rest of us paid to educate

I paid to educate people, too. I paid property taxes (the source of educational funding in California) for 30+ years, and never sent my kids to public school. I am also not the only person to benefit from the education of others.

More fundamentally, though, so what if others paid for my employee's education? If someone's parents paid for their child's education rather than taxes, should an employer be expected to pay the parents back? When I hire someone, I am paying them in accordance with their skills, knowledge and abilities. It's a mutually beneficial arrangement: employees get an income, and I get the benefit of their efforts; the more educated they are, the more they earn (to a point). Win-win.

BTW, the quality of US public education generally sucks. In many cases, I would often prefer to hire people who haven't been damaged by it.

you were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn’t have to worry that marauding bands would come and seize everything at your factory, and hire someone to protect against this, because of the work the rest of us did.

Those police and fire forces are using facilities and equipment that people like me designed and built for them -- structures, vehicles, computers, communications, etc, etc.

And again, I paid for those services as much as anyone else. And again, I'm also not the only one to benefit from them.

Police and fire services don't really keep me safe anyway; safety is much more a function of morality. Installing a new police force in Somalia wouldn't change anything.

Now look, you built a factory and it turned into something terrific, or a great idea? God bless. Keep a big hunk of it. But part of the underlying social contract is you take a hunk of that and pay forward for the next kid who comes along.

OK, now we're getting to the meat of it.

First, there is no social contract. That's simply an invention the Left uses to try to impose guilt or duty on us. A contract requires conscious and voluntary agreement between parties, and it presupposes the ability to reason, discuss and even disagree, so it's not something you can be born into. I certainly never agreed to anything like what Warren implies. What if I had been born in the Soviet Union or Nazi Germany? By Warren's logic, I would be required to live by those "social contracts" as well. No thanks.

My individual rights are not negotiable. No one, including government, has the right to take from me because of some perceived need -- or for any other reason. My life belongs to me.

Finally, perhaps the most important point: when I create a business, I am adding value to the world. I am employing people and producing a product or service that others value more than the money they give me in exchange. How about some thanks, some appreciation for that? No, the Left don't want to thank me, they want to destroy me; they want to steal my earnings while trying to portray me as evil. Why am I evil? Because I am successful, because I am good.

Wednesday, 21 September 2011

Ten things the government could do to help create jobs

There's been a lot in the press recently about the need to create jobs. Yet the only solutions offered seem to be things like cutting taxes or new spending on various government-sponsored job programs (Keynesianism). You would think it would obvious to most people by now that this doesn't work -- remember that $1 trillion "stimulus" from a few years ago? Did it help? Clearly not.

So if government spending doesn't work, then what's the answer? It's basically the opposite of what the government has been doing. Rather than increasing regulations and creating more and more barriers -- just get out of the frigging way!

[[MORE]]A few examples:

In addition, when the government borrows, it is competing with businesses for capital. Reducing government borrowing would therefore make more capital available to businesses, which would allow them to hire and grow.

So if government spending doesn't work, then what's the answer? It's basically the opposite of what the government has been doing. Rather than increasing regulations and creating more and more barriers -- just get out of the frigging way!

[[MORE]]A few examples:

- Repeal regulations. It may not even matter where you start -- almost all of them are bad.

- Allow failure. Freedom only works if it's also possible to fail. Don't protect companies from failure or mistakes; let them go bankrupt or be sued. You'd be shocked at how many laws there are that seek to interfere in this area.

- Make it easy for people to be fired. Although it might seem paradoxical at first, making it easy for an employer to fire their employees also makes it easier for them to hire. If an employer is likely to be stuck with someone they can't get rid of, it makes them reluctant to hire in the first place. Easy firing also lets them trim dead wood, so the truly productive are more likely to be rewarded.

- Abolish the minimum wage. Unemployment is highest among young adults. Is it better to work for a low, yet mutually agreed wage, or to not work at all? Keep in mind that even when working for a low wage, people are building experience -- which often leads to higher wages down the road.

- Repeal all laws that require jobs to be licensed. You need a license these days even if you want to just wash someone else's hair. Licensing has become a way for people who do certain jobs to put up barriers against competition. Caveat emptor is a much better policy.This would be especially effective at reducing healthcare costs.

- Allow employment testing. The Supreme Court's 1971 decision against employment testing ended up making it much more risky for employers to hire, because they're can't be as confident in their hires as they would be otherwise.

- Repeal all "equal opportunity" laws. If an employer is forced to hire someone only due to their race or gender, and not because they are the best person available for that job, it means the company is less productive, and therefore able to support fewer jobs than it could otherwise.

- Reduce or eliminate corporate taxes. Higher profits means more money would be available for jobs. Corporations aren't living entities. The real burden of corporate taxes falls on their shareholders -- which includes many of today's ailing pension funds. Corporate taxes are really just hidden taxes on individuals; we pay them in higher prices for the things those companies produce.

- Something needs to be done about unions. I agree with the idea that people should be able to collectively bargain, and things like that. But current union-related laws go much further than that. It seems to me that what we see in Detroit today is largely a result of unions that have taken things too far. I don't know exactly what the solution is.

- Legalize owning and making stuff. There is a surprisingly huge list of things that are illegal to make or own in the US. For example, alcohol stills (which are legal in New Zealand, BTW). Once legalized, assuming there is demand, companies would spring up to manufacture them, and those companies would need employees -- as would supporting companies, such as accounting firms, transportation, distribution, wholesalers, retailers, construction, etc.

In addition, when the government borrows, it is competing with businesses for capital. Reducing government borrowing would therefore make more capital available to businesses, which would allow them to hire and grow.

Friday, 16 September 2011

Taxation in New Zealand

After a severe and protracted economic crisis in the late 1970s and early 1980s, New Zealand radically reformed its tax and banking systems, while also reducing regulation and protectionism, and liberalizing free trade. The results are impressive; the Heritage Foundation’s 2010 survey ranked New Zealand fourth in the world for economic freedom.The New Zealand government also had a tax surplus from 1994 to 2008.

New Zealand does not have capital gains or inheritance taxes. Interest and dividends are taxed as regular income. For individuals, very few expenses are deductible. For example, you cannot deduct mortgage interest or capital losses. The income tax form is short in comparison to the equivalent forms in the United States; for 2010 it consists of forty one “lines.” Property taxes (called “rates”) are low, and apply only to land, not to improvements or other forms of business property. Local city councils collect and spend rates.

[[MORE]]If you make a living working in a certain field, then New Zealand does not consider earnings from that work to be capital gains. For example, if you trade stocks for a living, then those gains would be taxable, whereas if you only make occasional investments in stocks while having a job in another field, then they would not be, nor would losses be deductible.

There are four personal income tax rate brackets. The rates for 2009 ranged from 12.5 to 38 percent, with the maximum rate applied to earnings over NZ$70,000. The rates declined slightly in 2010, and now range from 10.5 to 33 percent. You can claim a credit for income under NZ$9,880, with the effect that if you earn less than that, you will not owe any income tax. Seventy five percent of New Zealand residents are in the intermediate 17.5 percent bracket (up to NZ$48,000). The corporate tax rate is a flat 30 percent, and will be decreasing to 28 percent in 2011.

New Zealand bases personal income taxes on individual income only; there are no “joint” returns or brackets. As an example, assume a husband works and his wife stays at home and they have a joint savings account. The husband will owe tax on his earned income plus half of the interest income. His wife will owe tax only on half of the interest income, potentially at a much lower rate than her husband will.

Employers deduct most income taxes at the source, through the pay as you earn (PAYE) program. Banks and other financial institutions deduct taxes from interest and dividend payments through the resident withholding tax (RWT) program. One way that PAYE differs from RWT is that PAYE includes an additional 2% fee for no-fault accident insurance (ACC). Although New Zealand has a publicly funded healthcare system, people injured in an accident can receive additional benefits, such as physical therapy or compensation for lost wages.

One advantage of New Zealand’s approach to income taxes compared to the United States is that the end-to-end system is reasonably comprehensible by the public. It is possible to estimate accurately the impact of changes in income or tax rates on yourself as well as others. This helps facilitate better economic planning, which is important for a well-functioning economy. If you cannot plan, or if your planning is error prone, it is easy to make a wide variety of financial mistakes. For example, you might end up with a level of debt you cannot afford to service, or you might unnecessarily defer the purchase of assets that you could have put to good use.

The motivation for not taxing capital gains stems in part from a respect for property rights, as well as from a desire to limit the benefits government receives from inflation. When capital gains are taxable, inflation alone can cause a nominal gain, even when there is a loss of purchasing power. For example, if you buy an asset for $1,000, and after one year without inflation, you sell the asset for $900, you would have a $100 capital loss. Now assume that there is 20 percent per year inflation. The sales price would be $1,080; you would have an $80 capital gain, even though there is a loss in constant dollar terms. Inflation plus a capital gains tax will amplify your losses (and your gains) compared to depreciation alone.

New Zealand has a national sales tax called the goods and services tax (GST). Items that you purchase overseas and import into the country are also subject to GST, with a NZ$50 minimum threshold per transaction. Instead of the government providing exemptions for companies and individuals who collect GST on the goods and services they sell, those entities file periodic GST returns where they can claim a credit for GST they have paid. If they pay more in GST than they collect, they receive a refund.

Only a few goods and services are exempt from GST, such as donations to non-profits, which they then sell, financial services such as bank fees, and rent for a residential dwelling. The most interesting exemptions are for fine gold, silver and platinum. The combination of no capital gains tax and no GST has the potential of enabling a form of penalty-free trading using precious metals as money, although such a market has not yet materialized.

The GST tax rate started out at 10% when New Zealand introduced it in 1986; it went up later to 12.5 percent. As part of the legislative package that decreased income tax rates in 2010, GST increased from 12.5 to 15 percent.

In addition to GST, the government also imposes excise taxes (duties) on a number of imported items, including alcohol, tobacco, fuels, carpets, footwear, hats, apparel, bedding, cosmetics, amplifiers, and so on. Typical rates vary from 5 to 10 percent of cost.

A duty used to be payable on gifts over a certain amount. The government has decided to eliminate that tax in 2011, largely due to the high cost of administration compared with the relatively small revenue that was taken in. As a result, gifts of any size are now tax-free. This change also fits with not having an inheritance tax; the idea is that you pay taxes only when you earn the money, not when you give it away, either voluntarily or upon death.

The government raises roughly 45 percent of its total revenue from individual income taxes, and about 20 percent from GST. Corporate taxes, duties, investment income and other taxes make up the remainder.

New Zealand’s central bank is the Reserve Bank of New Zealand (RBNZ). The government restructured the RBNZ charter in 1989, in the aftermath of the financial crisis in the early 1980s. The law under which the government chartered the bank defines its primary function as providing stability in the general level of prices. New Zealand was the first country to adopt a formal inflation target. Unlike the Federal Reserve, the RBNZ charter does not include managing the level of employment or other aspects of the economy. New Zealand does not provide FDIC-like bank deposit insurance, whether through RBNZ or otherwise.

The combination of not allowing mortgage interest to be deductible, having a central bank focused on controlling inflation, and a lack of bank deposit insurance superficially discourages debt and inflation. Even so, it was not enough to prevent the country from having a modest real estate bubble; prices have roughly doubled over the last ten years.

Having lived with the New Zealand tax system since moving here from the United States four years ago, overall I find it to be a breath of fresh air. Eventually, I would like to see the country move to a more limited government that is entirely funded by voluntary fees. The purpose of government should be to protect our rights. Taxation requires force or the threat of force to enforce it. As a result, through this implicit or explicit force, government is violating our rights. This puts government in a constant state of both internal and external conflict: “violating your rights in order to protect them.”

In the near term, on the path to a voluntarily funded government, there are many things New Zealand could do, in addition to the often suggested “cut spending and taxes.” To encourage saving, which helps minimize the true cost of capital, I would like to see taxes on interest income eliminated. To help reverse the decline in domestic industrial growth, the government could reduce personal and corporate income taxes, and offset the revenue loss with an increase in import duties. Import duties are potentially avoidable, so they are a more moral option than income taxes. Import duties could also be made uniform, so they do not damage or benefit one industry more than another.

New Zealand does not have capital gains or inheritance taxes. Interest and dividends are taxed as regular income. For individuals, very few expenses are deductible. For example, you cannot deduct mortgage interest or capital losses. The income tax form is short in comparison to the equivalent forms in the United States; for 2010 it consists of forty one “lines.” Property taxes (called “rates”) are low, and apply only to land, not to improvements or other forms of business property. Local city councils collect and spend rates.

[[MORE]]If you make a living working in a certain field, then New Zealand does not consider earnings from that work to be capital gains. For example, if you trade stocks for a living, then those gains would be taxable, whereas if you only make occasional investments in stocks while having a job in another field, then they would not be, nor would losses be deductible.

There are four personal income tax rate brackets. The rates for 2009 ranged from 12.5 to 38 percent, with the maximum rate applied to earnings over NZ$70,000. The rates declined slightly in 2010, and now range from 10.5 to 33 percent. You can claim a credit for income under NZ$9,880, with the effect that if you earn less than that, you will not owe any income tax. Seventy five percent of New Zealand residents are in the intermediate 17.5 percent bracket (up to NZ$48,000). The corporate tax rate is a flat 30 percent, and will be decreasing to 28 percent in 2011.

New Zealand bases personal income taxes on individual income only; there are no “joint” returns or brackets. As an example, assume a husband works and his wife stays at home and they have a joint savings account. The husband will owe tax on his earned income plus half of the interest income. His wife will owe tax only on half of the interest income, potentially at a much lower rate than her husband will.

Employers deduct most income taxes at the source, through the pay as you earn (PAYE) program. Banks and other financial institutions deduct taxes from interest and dividend payments through the resident withholding tax (RWT) program. One way that PAYE differs from RWT is that PAYE includes an additional 2% fee for no-fault accident insurance (ACC). Although New Zealand has a publicly funded healthcare system, people injured in an accident can receive additional benefits, such as physical therapy or compensation for lost wages.

One advantage of New Zealand’s approach to income taxes compared to the United States is that the end-to-end system is reasonably comprehensible by the public. It is possible to estimate accurately the impact of changes in income or tax rates on yourself as well as others. This helps facilitate better economic planning, which is important for a well-functioning economy. If you cannot plan, or if your planning is error prone, it is easy to make a wide variety of financial mistakes. For example, you might end up with a level of debt you cannot afford to service, or you might unnecessarily defer the purchase of assets that you could have put to good use.

The motivation for not taxing capital gains stems in part from a respect for property rights, as well as from a desire to limit the benefits government receives from inflation. When capital gains are taxable, inflation alone can cause a nominal gain, even when there is a loss of purchasing power. For example, if you buy an asset for $1,000, and after one year without inflation, you sell the asset for $900, you would have a $100 capital loss. Now assume that there is 20 percent per year inflation. The sales price would be $1,080; you would have an $80 capital gain, even though there is a loss in constant dollar terms. Inflation plus a capital gains tax will amplify your losses (and your gains) compared to depreciation alone.

New Zealand has a national sales tax called the goods and services tax (GST). Items that you purchase overseas and import into the country are also subject to GST, with a NZ$50 minimum threshold per transaction. Instead of the government providing exemptions for companies and individuals who collect GST on the goods and services they sell, those entities file periodic GST returns where they can claim a credit for GST they have paid. If they pay more in GST than they collect, they receive a refund.

Only a few goods and services are exempt from GST, such as donations to non-profits, which they then sell, financial services such as bank fees, and rent for a residential dwelling. The most interesting exemptions are for fine gold, silver and platinum. The combination of no capital gains tax and no GST has the potential of enabling a form of penalty-free trading using precious metals as money, although such a market has not yet materialized.

The GST tax rate started out at 10% when New Zealand introduced it in 1986; it went up later to 12.5 percent. As part of the legislative package that decreased income tax rates in 2010, GST increased from 12.5 to 15 percent.

In addition to GST, the government also imposes excise taxes (duties) on a number of imported items, including alcohol, tobacco, fuels, carpets, footwear, hats, apparel, bedding, cosmetics, amplifiers, and so on. Typical rates vary from 5 to 10 percent of cost.

A duty used to be payable on gifts over a certain amount. The government has decided to eliminate that tax in 2011, largely due to the high cost of administration compared with the relatively small revenue that was taken in. As a result, gifts of any size are now tax-free. This change also fits with not having an inheritance tax; the idea is that you pay taxes only when you earn the money, not when you give it away, either voluntarily or upon death.

The government raises roughly 45 percent of its total revenue from individual income taxes, and about 20 percent from GST. Corporate taxes, duties, investment income and other taxes make up the remainder.

New Zealand’s central bank is the Reserve Bank of New Zealand (RBNZ). The government restructured the RBNZ charter in 1989, in the aftermath of the financial crisis in the early 1980s. The law under which the government chartered the bank defines its primary function as providing stability in the general level of prices. New Zealand was the first country to adopt a formal inflation target. Unlike the Federal Reserve, the RBNZ charter does not include managing the level of employment or other aspects of the economy. New Zealand does not provide FDIC-like bank deposit insurance, whether through RBNZ or otherwise.

The combination of not allowing mortgage interest to be deductible, having a central bank focused on controlling inflation, and a lack of bank deposit insurance superficially discourages debt and inflation. Even so, it was not enough to prevent the country from having a modest real estate bubble; prices have roughly doubled over the last ten years.

Having lived with the New Zealand tax system since moving here from the United States four years ago, overall I find it to be a breath of fresh air. Eventually, I would like to see the country move to a more limited government that is entirely funded by voluntary fees. The purpose of government should be to protect our rights. Taxation requires force or the threat of force to enforce it. As a result, through this implicit or explicit force, government is violating our rights. This puts government in a constant state of both internal and external conflict: “violating your rights in order to protect them.”

In the near term, on the path to a voluntarily funded government, there are many things New Zealand could do, in addition to the often suggested “cut spending and taxes.” To encourage saving, which helps minimize the true cost of capital, I would like to see taxes on interest income eliminated. To help reverse the decline in domestic industrial growth, the government could reduce personal and corporate income taxes, and offset the revenue loss with an increase in import duties. Import duties are potentially avoidable, so they are a more moral option than income taxes. Import duties could also be made uniform, so they do not damage or benefit one industry more than another.

Wednesday, 14 September 2011

Update on brushing my teeth with soap

As I posted some time ago, I was brushing my teeth with soap instead of toothpaste. It worked great on my teeth and gums. However, I decided to stop a while back.

Because soap is a natural antibacterial, it was apparently disturbing the natural balance of bacteria in my mouth and throat -- to the point where I eventually got a bad case of thrush (yeast overgrowth), which was an unpleasant experience, to say the least.

This may not happen with everyone who brushes with soap; I think I'm sensitive in this area. It may also depend to some degree on the type of soap you use. You could probably also offset the antibacterial effect of soap by having a spoonful of acidophilus yoghurt after you brush.

The toothpaste I'm using now doesn't have sodium lauryl sulphate or fluoride, but it does have glycerin. Even so, I was encouraged at a recent dental hygiene appointment with no gum pocket depths greater than 3mm (5mm is considered the threshold for gum disease).

Because soap is a natural antibacterial, it was apparently disturbing the natural balance of bacteria in my mouth and throat -- to the point where I eventually got a bad case of thrush (yeast overgrowth), which was an unpleasant experience, to say the least.

This may not happen with everyone who brushes with soap; I think I'm sensitive in this area. It may also depend to some degree on the type of soap you use. You could probably also offset the antibacterial effect of soap by having a spoonful of acidophilus yoghurt after you brush.

The toothpaste I'm using now doesn't have sodium lauryl sulphate or fluoride, but it does have glycerin. Even so, I was encouraged at a recent dental hygiene appointment with no gum pocket depths greater than 3mm (5mm is considered the threshold for gum disease).

Sunday, 11 September 2011

An alternative to Left vs. Right in politics

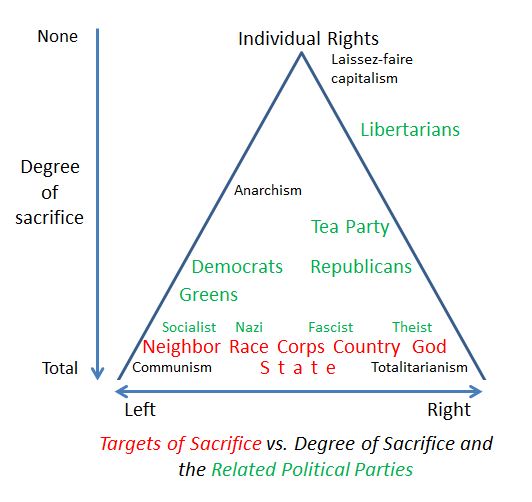

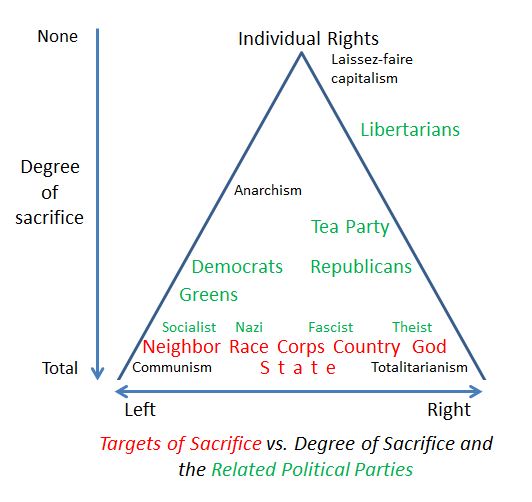

The perennial Left vs. Right model in politics is terribly misleading. It presents a false dichotomy, and therefore a false choice. I thought it would be interesting to come up with a diagram that more accurately expresses the spectrum of political choices:

The X axis is the traditional Left vs. Right model. The Y axis shows the degree of sacrifice that's required from a particular political party or system. The political parties are shown in green, political systems are black, and the targets of sacrifice are red.

What I'm trying to show here is that the fundamental difference between the Left and the Right today is not, say, the support of individual rights vs. collectivism. Rather, they both advocate sacrifice, just to different targets. The Democrats want us to sacrifice ourselves to our neighbors, so they support egalitarianism, welfare programs of all kinds, and uses of taxation for both purposes. They are also strong supporters of various racist agendas, such as "equal opportunity" (a misnomer if there ever was one) and multiculturalism. The Republicans want us to sacrifice to corporations and the country (endless wars), and they have a strong religious agenda too.

[[MORE]]You can see where the fringe parties and political systems of today fall. The Greens want more sacrifice than the Democrats, by having us sacrifice ourselves to the environment. Anarchists advocate less sacrifice than Democrats, while often still preaching egalitarianism or other forms of sacrifice to your neighbor, or sacrifice all-to-all. The Tea Party wants a little less sacrifice than Republicans, by being against sacrifice to corporations, but they would be happy to sacrifice to God and country.

Although there are certainly atheists in the Libertarian camp, my experience with them as a group is that they tend to support sacrificing themselves to God to some degree. Since they adopt the non-initiation of force principle as a primary (rather than in an appropriate context), they also tend to be pacifists who support sacrificing themselves to their enemies. However, they generally prefer eliminating sacrifice to both corporations and the country.

As we move down the Y axis, true socialist governments take sacrificing to your neighbor to even greater extremes with actions such as government ownership of major industries. The people of Nazi Germany sacrificed themselves to the Aryan race; that was the true name in which many of their atrocities were committed. Italian-style Fascism demanded sacrifice to the country (Nationalism) and happily created a marriage of corporations with the State. Theistic states such as Iran demand sacrifice to God.

At the level of total sacrifice, we have communism on the left, such as in the Soviet Union, where private property and working for profit ("speculation") were outlawed. On the right, we have totalitarianism, which would be a type of feudalism, where a King rules by fiat.

At the top of the diagram's triangle, not sacrificing to anyone means supporting individual rights as a primary, which leads to laissez-faire capitalism. This is a "hands off" type of capitalism, limited mainly by laws against the use of force or fraud, but free of modern regulation.

The diagram also helps to illustrate the tendency of humans when it comes to politics to move down the Y axis, toward increasing levels of sacrifice -- which also naturally leads to increasing violence and war. Jumps up the Y axis are relatively rare, yet also very powerful when they do happen, such as with The Enlightenment.

The X axis is the traditional Left vs. Right model. The Y axis shows the degree of sacrifice that's required from a particular political party or system. The political parties are shown in green, political systems are black, and the targets of sacrifice are red.

What I'm trying to show here is that the fundamental difference between the Left and the Right today is not, say, the support of individual rights vs. collectivism. Rather, they both advocate sacrifice, just to different targets. The Democrats want us to sacrifice ourselves to our neighbors, so they support egalitarianism, welfare programs of all kinds, and uses of taxation for both purposes. They are also strong supporters of various racist agendas, such as "equal opportunity" (a misnomer if there ever was one) and multiculturalism. The Republicans want us to sacrifice to corporations and the country (endless wars), and they have a strong religious agenda too.

[[MORE]]You can see where the fringe parties and political systems of today fall. The Greens want more sacrifice than the Democrats, by having us sacrifice ourselves to the environment. Anarchists advocate less sacrifice than Democrats, while often still preaching egalitarianism or other forms of sacrifice to your neighbor, or sacrifice all-to-all. The Tea Party wants a little less sacrifice than Republicans, by being against sacrifice to corporations, but they would be happy to sacrifice to God and country.

Although there are certainly atheists in the Libertarian camp, my experience with them as a group is that they tend to support sacrificing themselves to God to some degree. Since they adopt the non-initiation of force principle as a primary (rather than in an appropriate context), they also tend to be pacifists who support sacrificing themselves to their enemies. However, they generally prefer eliminating sacrifice to both corporations and the country.

As we move down the Y axis, true socialist governments take sacrificing to your neighbor to even greater extremes with actions such as government ownership of major industries. The people of Nazi Germany sacrificed themselves to the Aryan race; that was the true name in which many of their atrocities were committed. Italian-style Fascism demanded sacrifice to the country (Nationalism) and happily created a marriage of corporations with the State. Theistic states such as Iran demand sacrifice to God.

At the level of total sacrifice, we have communism on the left, such as in the Soviet Union, where private property and working for profit ("speculation") were outlawed. On the right, we have totalitarianism, which would be a type of feudalism, where a King rules by fiat.

At the top of the diagram's triangle, not sacrificing to anyone means supporting individual rights as a primary, which leads to laissez-faire capitalism. This is a "hands off" type of capitalism, limited mainly by laws against the use of force or fraud, but free of modern regulation.

The diagram also helps to illustrate the tendency of humans when it comes to politics to move down the Y axis, toward increasing levels of sacrifice -- which also naturally leads to increasing violence and war. Jumps up the Y axis are relatively rare, yet also very powerful when they do happen, such as with The Enlightenment.

Friday, 9 September 2011

Would you take statins for high cholesterol?

If I had high cholesterol, I wouldn't statin drugs, for two reasons. First, from what I've seen, the research is not clear that reducing cholesterol levels has any real long-term benefit with regard to heart disease. Second, the drugs themselves have a terrible side-effect profile. For those who decide to go that way, though, be sure to take Co-Q10 to help minimize the damage.

I had a heart scan done myself about 5 yrs ago, and would highly recommend the procedure. Although mine came back clear, I could imagine that having someone tell you that they suspect plaque has started to form in the vessels affecting your heart is nothing like actually seeing and measuring them.

Instead of statins, look into the Pauling/Rath protocol for reversing heart disease. Basically, Lysine, Proline, Vitamin C, Co-Q10, Carnitine, Niacin and Vit E.

[[MORE]]Arginine supplementation can also be useful. It helps by increasing nitric oxide release in tissues, which in turn promotes wound healing (such as in the arterial walls; plaques form in response to wall damage), and helps to dilate blood vessels. Dr Joe Prendergrast's work in this area is very interesting.

If the heart scan does show some calcification, consider having EDTA chelation therapy, which can help dissolve the plaques. It's a slow process (once a week for 20+ weeks), but it has a pretty good track record, particularly when the plaques aren't too thick. The most effective approach is by IV, but it can also be done using EDTA suppositories -- the latter takes longer and requires some care in administration, but you might prefer it to getting stuck with an IV needle. Used in conjunction with a heart scan, you can actually track your progress.

Watch your blood pressure. High BP can damage blood vessels; repeated micro-damage means more plaques.

Also, watch/limit your calcium intake and Vit D level. There is a bunch of interesting work in this area. Tom Levy of Vit C fame was planning a book on the subject.

I had a heart scan done myself about 5 yrs ago, and would highly recommend the procedure. Although mine came back clear, I could imagine that having someone tell you that they suspect plaque has started to form in the vessels affecting your heart is nothing like actually seeing and measuring them.

Instead of statins, look into the Pauling/Rath protocol for reversing heart disease. Basically, Lysine, Proline, Vitamin C, Co-Q10, Carnitine, Niacin and Vit E.

[[MORE]]Arginine supplementation can also be useful. It helps by increasing nitric oxide release in tissues, which in turn promotes wound healing (such as in the arterial walls; plaques form in response to wall damage), and helps to dilate blood vessels. Dr Joe Prendergrast's work in this area is very interesting.

If the heart scan does show some calcification, consider having EDTA chelation therapy, which can help dissolve the plaques. It's a slow process (once a week for 20+ weeks), but it has a pretty good track record, particularly when the plaques aren't too thick. The most effective approach is by IV, but it can also be done using EDTA suppositories -- the latter takes longer and requires some care in administration, but you might prefer it to getting stuck with an IV needle. Used in conjunction with a heart scan, you can actually track your progress.

Watch your blood pressure. High BP can damage blood vessels; repeated micro-damage means more plaques.

Also, watch/limit your calcium intake and Vit D level. There is a bunch of interesting work in this area. Tom Levy of Vit C fame was planning a book on the subject.

Subscribe to:

Posts (Atom)